nse: jpinfratec: Jaypee Infratech Ltd is an Indian infrastructure development company. The company is a part of the Jaypee Group. They are engaged in the development of the Yamuna Expressway and related real estate projects. However, The company`s business model consists of earning revenues from traffic and related facilities on the expressway during the 36-year Concession period and development of associated real estate pursuant to the Concession.

The Yamuna Expressway is a 165-kilometre access-controlled six-lane concrete pavement expressway along the Yamuna river, with the potential to be widened to an eight-lane expressway. The company also has the right to develop 25 million square metres (approximately 6,175 acres) of land along the Yamuna Expressway at five locations for residential, commercial, amusement, industrial and institutional purposes. So, The company holds the Concession from the YEA to develop, operate and maintain the Yamuna Expressway in the state of Uttar Pradesh.

The company received the certificate for commencement of business on April 27, 2007. In Oct 2007, Jaiprakash Associates Ltd and Yamuna Expressway Authority assigned the assignment in favour of the company. Also, the holding company Jaiprakash Associates Ltd executed the project transfer agreement in favour of the company.

https://youtu.be/f5FkpfEPi-U?t=36

In Dec 2007, they commenced the construction of Yamuna Expressway, in Nov 2008, the company launched the residential project `Jaypee Greens Klassic` at Noida in Uttar Pradesh. they launched the residential project `Jaypee Greens Kosmos` at Noida in Uttar Pradesh.

In Oct 2009, the company commenced the construction of the Jaypee medical super speciality 450 bed hospital, at Noida, Uttar Pradesh, India. So, In January 2010, `JG Kensington Park (Plots)` at Noida in Uttar Pradesh and in February 2010, they launched the residential project `Jaypee Greens Kensington Park (Apartments)` at Noida in Uttar Pradesh.

Table of Contents

Registered Details – nse: jpinfratec – Jaypee Infratech Limited

CIN

L45203UP2007PLC033119

INCORPORATION DATE / AGE

05 April, 2007 / 16 yrs

LAST REPORTED AGM DATE

26 September, 2019

AUTHORIZED CAPITAL

INR 300000.0 Lacs

PAIDUP CAPITAL

INR 138893.3497 Lacs

INDUSTRY*

Construction

TYPE

Listed Public Company

CATEGORY

Company limited by Shares

SUBCATEGORY

Non-govt company

EMAIL ADDRESS

Login for email address. This is to prevent spam.

WEBSITE

http://www.jaypeeinfratech.com/. (Incorrect website?)

REGISTERED ADDRESS

Sector-128

Noida – 201304

Uttar Pradesh – India

Jaypee Infratech Limited – nse: jpinfratec

nse: jpinfratec Jaypee Infratech Limited is a Public incorporated on 05 April 2007. It is secret as Non-govt company and is registered at Registrar of Corporations, Kanpur. Its authorized share capital is Rs. 30,000,001,000 and its paid up capital is Rs. 13,889,335,300. It is inolved in Building of complete constructions or parts thereof; civil engineering

Jaypee Infratech Limited’s Annual General Meeting (AGM) was last held on 26 September 2019 and as per records from Ministry of Corporate Affairs (MCA), its stability sheet was last filed on 31 March 2019.

Directors of Jaypee Infratech Limited are Rakesh Sharma, Rekha Dixit,.

Jaypee Infratech Limited’s Corporate Identification Number is (CIN) L45203UP2007PLC033119 and its registration number is 33119.Its Email address is JPINFRATECH.INVESTOR@JALINDIA.CO.IN and its registered address is Sector-128 Noida UP 201304 IN .

Jaypee Infratech Ltd shares SWOT Analysis

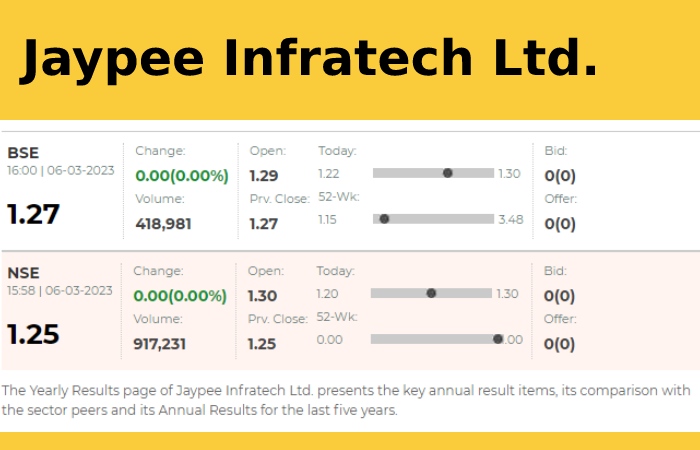

nse: jpinfratec – JPINFRATECSHARE Price

Open N/A Change Price %

High N/A 1 Day N/A N/A

Low N/A 1 Week N/A N/A

Close N/A 1 Month N/A N/A

Volume N/A 1 Year N/A N/A

52 Week High N/A | 52 Week Low N/A

NSE India Most Active Stocks

RPOWER 12.80 5.35%

YESBANK 15.35 -0.32%

SUZLON 8.05 -0.62%

JPPOWER 6.05 3.42%

IDEA 6.05 -2.42%

TATASTEEL 107.50 -0.09%

ICICIBANK 899.00 0.99%

BCG 15.45 -4.92%

PNB 47.75 1.49%

AUBANK 679.20 17.07%

Jaypee Infratech Ltd Stocks Comparison

Financials( ₹ in Cr) Larsen & Toubro HFCL Adani Ports GMR Airports Inf Jaypee Infratech

Price 2,258.75 63.85 661.65 43.90 1.25

% Change -1.30 1.03 0.59 0.46 0

Mcap ₹ Cr 3,17,436.59 8,796.98 1,42,925.60 26,497.80 173.62

Revenue TTM ₹ Cr 1,56,521.23 4,727.11 15,934.03 4,600.72 1,065.94

Net Profit TTM ₹ Cr 10,291.05 325.87 4,795.24 -1,131.39 -2,413.46

PE TTM 31.66 29.85 27.61 0.00 0.00

1 Year Return 29.24 -19.23 -21.69 11.42 -56.90

ROCE 11.30 18.77 10.44 0.00 0.00

ROE 13.00 13.82 14.00 0.00 0.

nse: jpinfratec Synopsis Technicals View

50 Day EMA Close is Below EMA 50 (Short Term)

Bearish

100 Day EMA Close is Below EMA 100 (Mid Term) Bearish

200 Day EMA Close is Below EMA 200 (Long Term) Bearish

MACD (12 26 9) MACD Line is Less Then SIGNAL Line Bearish

RSI (14) RSI is Below 30 Over Sold

MFI (14) MFI is 71.29 Sideways

CCI (20) CCI is Below -100 Over Sold

WILLIAM %R (14) William %R is Below -80 Over Sold

ADX (14) ADX is Above 20 & +DI is Below -DI Down Trend

PSAR Stoploss For Short Sell 1.07

10 Day Avg Volume Traded -43.92 % Less then 10 Day Average Volume.

JAYPEE INFRATECH Revenues

[BOM: 533207|NSE : JPINFRATEC]

Y-o-Y

33.64 %

5 Yr CAGR

10.17 %

Years Revenues % Change

Mar2022 ₹1,066 Cr 33.64

Mar2021 ₹798 Cr -57.51

Mar2020 ₹1,877 Cr 16.54

Mar2019 ₹1,611 Cr 122.61

Mar2018 ₹724 Cr 225.72

Relative Value

The Relative Value of one JPINFRATEC stock under the base case scenario is 9.15 INR. Moreover, Compared to the current market price of 1.25 INR, Jaypee Infratech Ltd is undervalued by 86%.

Relative valuation is one of two procedures of hiring a monetary value on a company; the other is Discounted Cash Flow valuation method. We practice a combination of these two methods to calculate the Intrinsic Value of stock as accurately as possible.

Profitability summary

Jaypee Infratech Ltd’s profitability score is 56/100. We take all the info about a corporation’s profitability (such as its margins, capital efficiency, free cash flow producing ability, and more) and combine it into one single number. The cost-effectiveness score. The higher the productivity score, the more profitable the company is.

Past Growing

In addition, To be successful and continue in business, both growth and profitability are significant and necessary. Net Income growth is frequently seen as a sign of a business’s efficiency from an operative standpoint, but is influenced heavily by a company’s goals and trials and should therefore be judged in conjunction with other metrics like revenue and operating income growth.

Free Cash Flow

Free -cash flow (FCF) is the cash a business has left over after disbursing its operating expenses and capital expenditures. The more free cash flow a firm has, the more it can assign to dividends, paying down debt, and development opportunities.

If a company has a lessening free cash flow, Moreover, that is not necessarily bad if the company is investing in its growth.

What is the problem with Jaypee Infratech?

Jaypee Infratech Ltd is facing corporate insolvency resolution process (CIRP) since August 2017. In November last year, the National Company Law Tribunal (NCLT) reserved its order on Mumbai-based Suraksha group’s bid to acquire Jaypee Infratech Ltd and complete around 20,000 flats for aggrieved homebuyers.1

Jaypee Infra insolvency

NCLT approved the Suraksha cluster’s bid to buy Jaypee Infratech Ltd, a growth that comes as a relief for more than 20,000 homebuyers almost six years after the debt-ridden firm entered into the bankruptcy process.

Moreover, The ruling, which came nearly two years after the CoC gave its nod for Suraksha group’s offer, will pave the way for the completion of more than 20,000 housing units in various stalled projects of JIL spread mainly across Noida and Greater Noida in the national capital.

However, While passing the order, the tribunal rejected the objections made by Yamuna Expressway Industrial Development Authority (YEIDA). Dissenting financial creditor ICICI Bank and JIL’s parent firm Jaiprakash Associates Ltd (JAL).

In its 491-page directive. The NCLT had engaged that JIL will get Rs 542.62 crore out of Rs 750 crore dropped by Jaiprakash Associates Ltd (JAL) in the registry of the Highest Court. while Rs 106.9 crore will go to an escrow account of homebuyers.

Jaypee Infratech Ltd:

1.27

0.00 (0.00 %)

BSE

Open Free Trading Account Online with ICICIDIRECT

Sign up for a New Account

Enter Your Mobile Number

Jaypee Infratech Ltd shares SWOT Analysis

SWOT

TECHNICALS

DEALS

SHAREHOLDING

STRENGTHS (0)

Data not found

WEAKNESS (0)

Data not found

OPPORTUNITY (0)

Data not found

THREATS (0)

Data not found

DISCOVER MORE

FINANCIALS

PROFIT AND LOSS STATEMENT

BALANCE SHEET

QUARTERLY RESULT

RATIO

Sales

Operating Profit

Profit after Tax

DISCOVER MORE

Contact Details

Email ID: JPINFRATECH.INVESTOR@JALINDIA.CO.IN

Website: Click here to add.

Address:

Sector-128 Noida UP 201304 IN

Conclusion:

Adjusted price is showed when the security is experiencing a Corporate Action such as Dividend, Plus, Rights or Face Worth Split. On Trade Action (Ex-date), the %change on is calculated with reverence to the Used to Price.

i-NAV :i-NAV (Revealing NAV) for an ETF is showed as acknowledged from AMCs during each business day.

For securities that undertake call auction in superior pre-open session in case of New/IPO Listings; Re-Listing; Business Action; Surveillance action etc., the % change is intended with respect to symmetry price determined in the session.

Close price will be efficient after 18.15 hrs on explanation of joint press announcement 52 week High/Low: Amounts are adjusted for Business Action such as Extra, Face Charge Split, Rights etc.